- Home

- SRTC Procedure Manual

- 4.2sr - SRTC Procedure: Work Schedules, Meal and Rest Periods, and Timekeeping

4.2sr - SRTC Procedure: Work Schedules, Meal and Rest Periods, and Timekeeping

I. PURPOSE:

All employees of Southern Regional Technical College (SRTC) are covered by the Wage and Hour provisions of the Fair Labor Standards Act unless specifically exempted. The Fair Labor Standards Act (FLSA or Act) of 1938, as amended, establishes minimum wage rates, maximum work hours, overtime pay requirements, equal pay standards, and child labor restrictions for employees covered by its provisions. Included are guidelines governing required record keeping for non-exempt employees. Pursuant to State of Georgia policy, non-exempt, salaried employees shall receive FLSA Compensatory Time for all overtime hours worked. In those unique circumstances in which the delivery of FLSA Compensatory Time is not a viable consideration, SRTC may request authorization from the TCSG Budget Office to deliver overtime payment(s) in cash. If the TCSG Budget office concurs, a written request shall be submitted to the Office of Planning and Budget (OPB) for review. Cash payment(s) for overtime hours worked will not be initiated by SRTC unless formal OPB approval has first been obtained.

Pursuant to State of Georgia policy and with the exception of a regular, salaried employee working less than full-time (e.g., thirty (30) hours per week) as well as certified law enforcement employees serving in SRTC’s police department, all other, salaried employees of SRTC shall either work, utilize paid leave or holidays, or be placed on authorized or unauthorized leave without pay for forty (40) hours each seven (7) day work week/work period. Work period requirements for certified law enforcement employees are outlined in paragraph VI.E. Within these parameters, the President of SRTC shall establish the official and core business hours for the technical college. The President, or his/her designee, shall ensure that employee work schedules are established to facilitate the effective and efficient operation of the college. Additionally, it is the responsibility of the President to ensure that college operations comply with all applicable provisions of the Fair Labor Standards Act, as well as the State of Georgia policy governing Working Hours, Payment of Overtime, and Granting of Compensatory Time.

II. RELATED AUTHORITY:

SBTCSG Policy 4.2.1: Working Hours, Overtime, and Compensatory Time

TCSG Procedure 4.2.1p: Working Hours, Overtime, and Compensatory Time

SBTCSG Policy 4.2.2: Official Business Hours and Work Schedules

TCSG Procedure 4.2.2p1: Official Business Hours and Work Schedules

III. APPLICABILITY:

All work units associated with Southern Regional Technical College.

IV. DEFINITIONS:

Exempt Employees: Employees who, because of their job duties, are not subject to the minimum wage, overtime and recordkeeping provisions of the Fair Labor Standards Act. Exemptions from the Act are narrowly defined and an employer must prove that the exemption rules apply.

Core Business Hours: The time period during a normal business day that employees working a schedule with flexible starting and ending times are required to be present at work. Example would be core hours from 9:00 a.m. until 3:00 p.m. An employee with these core hours could be permitted to begin his/her work day between 7:00 a.m. and 9:00 a.m. and end his/her day between 3:30 p.m. and 5:30 p.m. inclusive of an unpaid lunch period of at least thirty (30) minutes.

Hours Worked: Generally, all time spent on an employer’s premises or at a designated work place is considered “hours worked” when an employee is required or permitted to perform services of benefit to the employer, except for meal periods of at least thirty (30) minutes (in length) or other periods when the employee is entirely free from duty. Also included as “hours worked” is any work which the employee performs for the employer’s benefit outside of established work hours on or off the employer’s premises (i.e., time spent before, after, or between regular working hours). Unrecorded hours worked during a work week/work period by an employee on or off the employer’s premises must be counted as “hours worked” if the employer knows or has reason to believe that the work is taking place and whether or not the work is performed with the employer’s approval.

Non-Exempt Employees: Employees who are covered by or subject to the minimum wage, overtime and recordkeeping provisions of the Fair Labor Standards Act.

Regular Rate: The hourly rate used to calculate overtime payments. If an employee is paid solely at one hourly rate of pay (i.e., for hourly-paid staff at the college), this is the individual’s “regular rate”. The regular rate of a salaried employee is calculated by dividing the individual’s total compensation (including annual salary and any additional salary supplements, shift differentials, etc.) by 2,080 hours. The regular rate for a P.O.S.T. certified law enforcement officer working a 207(k) schedule shall be determined pursuant to applicable provisions of the Office of Planning and Budget Rules, Regulations and Procedures Governing Working Hours, the Payment of Overtime and the Granting of Compensatory Time. NOTE: if an hourly-paid employee receives additional compensation, these monies are also factored into the calculating of his/her “regular rate”.

V. ATTACHMENTS:

Attachment A: Work Schedule Form

Attachment B: Compressed Workweek Agreement Form

Attachment C: Time Clock Acknowledgement

VI. PROVISIONS:

- Categories of Employees:

- Non-Exempt: those employees who are covered by or subject to the minimum wage, overtime and recordkeeping provisions of the Fair Labor Standards Act.

- Exempt: those employees who, because of their assigned job duties, are not subject to the FLSA’s minimum wage, overtime and recordkeeping provisions. Employees meeting the Act’s criteria for executive, professional, administrative, computer and other defined exemptions are exempt from overtime compensation although their employment must comply with the record-keeping and equal pay requirements of the Act.

- The designation of a position’s exempt and non-exempt status shall be based on criteria established by and through the Regulations of the Fair Labor Standards Act to include a thoughtful analysis of each position’s assigned duties and responsibilities. These exemptions are narrowly defined and if questions arise, the TCSG work unit must prove that the exemption rules apply. NOTE: a position’s job title is not a factor in determining whether the position is determined to be exempt from the FLSA.

- As a condition of employment, all newly hired employees must complete the Understanding Concerning FLSA Compensatory Time form during the on-boarding process.

- General Overtime Provisions of the FLSA and/or OPB Policy for State of Georgia Employees:

- Other than the exemption outlined below in Paragraph VI.B.2. all non-exempt employees must receive overtime compensation for all hours worked over forty (40) in a work week/work period.

- A partial overtime exemption from the FLSA, [i.e., Section 7(k) is available to public agency employers utilizing law enforcement, fire protection, hospital, and nursing home employees. Overtime compensation is not required until the employee works more than the maximum number of hours in his/her designated work period.

- Unless the provisions of Paragraph VI.O apply, overtime compensation for nonexempt, salaried employees shall be provided in FLSA compensatory time at a rate of one and one-half (1 ½) hours for each overtime hour worked. Overtime will be earned and compensated for in five (5) minute increments. As such, employee beginning and ending time should be rounded to the nearest five (5) minutes.

- Time off for state holidays, paid leave (to include compensatory time off) is not counted as hours worked for the purpose of calculating overtime payments.

- Overtime earnings, including FLSA compensatory time, must be calculated for each work week/work period. Hours cannot be averaged over two or more work weeks/work periods.

- It is both permissible and recommended that a work schedule adjustment (i.e. equivalent time off) be provided during a work week/work period in which a nonexempt employee works the maximum hours prior to the end of the work period/work week. This alternative will ensure that overtime hours will not be worked and will avoid the necessity for delivery overtime compensation.

- Official Business Hours:

- The campuses of Southern Regional Technical College observe varying hours of operation depending on the location. The following official business hours are as follows:

- Work Periods and Work Schedules for Non-Law Enforcement Employees:

- The work period for all non-law enforcement employees is a fixed period of seven (7) consecutive calendar days. Work units may establish different work periods for different groups of employees, provided there is a business-related justification. Unless otherwise stated in writing with approval from the President or his/her designee, the work period for all SRTC employees begins at 12:00 a.m. Sunday and ends at 11:59 p.m. Saturday.

- The scheduled work hours of each employee (to include an unpaid meal period and, as applicable, breaks) will be established in conjunction with the needs of the assigned work unit. Managers and supervisors may permit an employee to work desired hours provided the proposed schedule is consistent with college guidelines, work unit operations, and the schedules of other employees. Work schedules may vary from employee to employee dependent upon the type of work performed, work location, and the needs of the work unit.

- An established work period may be modified if the change is intended to be permanent and is not adopted to evade the overtime pay requirements of the FLSA. Employees in the same TCSG work unit may have different work weeks/work periods, provided there is a business-related justification.

- A fixed work period must be established in writing for all employees to include the day and time the work period begins and ends. This information must be maintained in the College’s Office of Human Resources.

- Employees may be permitted to work schedules that vary from the college official business hours (i.e., a flexible work schedule) or may request or be required to work a compressed work schedule as outlined below. In all such instances, an employee must be at work during core business hours.

- Participation in an alternative work schedule may be rescinded if there are performance or attendance problems present or other work-related issues as determined by the immediate supervisor or reviewing manager.

- When possible, an employee should be provided advance notice of a modification to his/her established work schedule.

- In addition to a standard work week consisting of five (5), eight (8) hour days, the following alternative work schedules may be incorporated into college operations with the approval of the President or his/her designee:

- Compressed Work Schedule: This schedule incorporates four (4), ten-hour (10) hour work days may, at the discretion of a technical college president, be adopted college-wide.

- Employees on a ten (10) hour per day schedule may be required to have an unpaid lunch period of at least thirty (30) minutes added to their established work schedule.

- An employee requesting to participate in a Compressed Work Schedule shall complete an accompanying agreement (i.e., Attachment B). Newly hired full-time employees of the college utilizing a four (4) day, ten (10) hour work schedule should complete Attachment B.

- Work Periods and Work Schedules for Law Enforcement Employees:

- The work period for all P.O.S.T. certified law enforcement employees serving in SRTC police department shall be established as a fixed period of fourteen (14) calendar days.

- Within SRTC the assigned work period shall generally be established in seven (7) day increments, e.g., seven (7) days, fourteen (14) days, or twenty-eight (28) days. NOTE: Different work periods may be established for different employees of groups of employees.

- For each work period, a regular, salaried law enforcement employee must work or use paid leave/holidays for no less than the scheduled amount of hours for the work period. This is equivalent to the number of scheduled work days multiplied by the number of scheduled hours per day.

For example, if an officer is assigned to a fourteen (14) day work period, his/her scheduled hours equals 80 hours. - The president (or his/her designee) may elect to waive the requirement of adding an unpaid meal period to the established work day of P.O.S.T. certified law enforcement employees.

- The established maximum hours worked standard before overtime compensation is required for non-exempt employees ranges from 43 hours (in a seven (7) day work period) to 171 hours (in a twenty-eight (28) day work period). Employees may be required to work up to the maximum number of hours in his/her designated work period without additional compensation.

- A salaried, non-exempt employee who works more than the maximum number of hours in his/her work period shall receive overtime compensation in the form of FLSA compensatory time calculated at a rate of one and one-half (1 ½) for each overtime hour worked.

- The provisions of Paragraph VI.D. and VI.E governing State Holidays and Annual, Sick, or Personal Leave and Compensatory Time are applicable to law enforcement employees whose assigned work day is either nine (9) or ten (10) hours.

- State Holidays

- Pursuant to State policy, holidays are valued at eight (8) hours.

- Employees working a nine (9) or ten (10) hour day must either adjust his/her work schedule during the work period in which the holiday(s) occur or, request annual/personal leave or available compensatory time or request placement on authorized leave without pay to make up the one (1) or two (2) hour difference.

- Annual, Sick, or Personal Leave and Compensatory Time

- Employees working a nine (9) or ten (10) hour day and who are absent from work on approved annual, sick, or personnel leave must request nine (9) or ten (10) hours of leave. Similarly, employees may request an equivalent amount of accumulated FLSA or State compensatory time for such absence(s).

- Hours Worked:

- With respect to non-exempt employees, work not requested but “suffered or permitted” is considered work time. This general rule also applies to work performed away from an employee’s regular work place to include his/her home. If a college official has reason to believe that work is being performed, the hours must be counted.

- In all instances, it is the responsibility of management to exercise its control and to ensure that work is not performed (by non-exempt employees) if it does not want the work performed.

- As noted, non-exempt employees must be compensated for all work performed for which a manager, supervisor, or other work unit official knows or has sufficient reason to believe it was performed. Non-exempt employees who work additional hours without authorization are subject to disciplinary action consistent with the provisions of the State Board policy on Positive Discipline.

- Non-exempt employees are required to report and document all hours worked – specifically hours worked each day and the total hours worked each work week/work period.

- Meal Periods:

- Although not mandated by the regulations of the Fair Labor Standards Act or Georgia State Law, and with the exception noted below, all full-time employees will be provided with an unpaid meal period as a part of their established work day.

- The president (or his/her designee) may elect to waive the requirements of adding an unpaid meal period to the established work day for P.O.S.T. certified law enforcement employees.

- Meal periods are not considered as “hours worked” provided a non-exempt employee does not perform any work. A meal period must be a minimum of thirty (30) minutes in length but may be longer at the discretion of management.

- Meal periods should be scheduled in a manner that does not negatively impact work unit operations.

- To limit the likelihood of a non-exempt employee performing work during his/her meal period, the employee should not be permitted to occupy his/her work station during the meal period.

- Breaks:

- Employees may be provided up to two (2) fifteen (15) minute breaks per work day. Breaks are considered as “hours worked” for compensation purposes.

- If the use of formal breaks has been authorized, this time may not be used to lengthen a meal period, report late to work, or leave work early by working through a break period.

- Given that break periods are a privilege for which an employee is compensated, no overtime or compensatory time is earned by an employee who is required to work through one or more break period(s).

- Employees must remain at their work site during a paid break.

- Break Time for Nursing Mothers:

- A non-exempt employee must be provided a reasonable amount of time to express breast milk for her nursing child, as needed, throughout the work day. Break(s) for this purpose must be provided for a period of one (1) year after a child’s birth.

- For purposes of this procedure, an exempt employee shall be provided the same opportunity to express breast milk as a non-exempt employee.

- The college must provide adequate space, other than a bathroom, for this activity. The space must be shielded from view and free from intrusion from coworkers and the public. Employees and supervisors are encouraged to contact an SRTC Human Resources Representative for guidance in locating a suitable location to meet these requirements.

- A non-exempt employee is not entitled to compensation for breaks taken to express breast milk; however, if a work unit is currently providing or elects to provide compensated breaks, a non-exempt employee who uses her break time to express milk must be compensated in the same manner as other employees.

- Meetings or Training:

- Time spent by non-exempt employees attending meetings, work-related training and/or similar activities is compensable (i.e., considered “hours worked”) unless each of the following conditions are met:

- The attendance is outside of the employee’s regular working hours;

- Attendance is voluntary;

- The meeting, training, etc., is not directly related to the employee’s current position and his/her assigned duties and responsibilities; and,

- The employee does not perform any productive work related to his/her position while in attendance.

- On Call Time:

- Time spent “on call” is not considered “hours worked” unless an employee:

- Is required to remain on the work premises; or,

- Is so restricted that he/she cannot use his/her “idle time” effectively for his/her own benefit.

- An employee who is merely required to carry a cell phone or other electronic device or provide his/her supervisor with contact information where he/she can be reached is not considered to be “at work” during the “on call” time period.

- All time a non-exempt employee spends actually working while “on call” is considered as “hours worked” and must be recorded on his/her time records for the work week/work period in which these activities occur.

- Travel Time:

- Normal commuting time to and from work is generally not compensable and is not considered as “hours worked”.

- Travel between a “normal” workplace, such as an office, and another place of assignment is usually considered as “hours worked”.

- Travel between one assignment and another during a work day is compensable and is considered “hours worked”.

- If travel time between a non-exempt employee’s home and the place of assignment on a one-day trip to another city (by an employee who normally has a fixed place of work) exceeds the time spent in the employee’s normal commute between home and work, all such excess time is compensable and is considered as “hours worked”.

- If an employee leaves from his/her normal place of work rather than from home on a one-day trip to another city, the travel between home and the normal place of work is not considered “hours worked”.

- Generally, overnight, out-of-town travel as a passenger (in a state vehicle, bus, airplane, or train) outside normal working hours does not have to be counted as 7 “hours worked”; however, it is the policy of the Technical College System of Georgia that such bona fide travel time of non-exempt employees will be considered “hours worked”.

- If a non-exempt employee is required to drive a state or personal vehicle on an overnight, out-of-town trip, all time spent driving the vehicle on work-related business will be considered “hours worked”.

- If a non-exempt employee is required to attend a meal or an associated activity event outside of his/her normal work hours, all such time will be considered “hours worked” and must be recorded on his/her time records for the work week/work period in which these activities occur.

- For those occasions which require a non-exempt employee to stay overnight for one or more business days, all time spent outside of regular work hours is not compensable unless: the employee is performing work; required to attend a meal or event; or, the employee is unable to use his/her idle time for his/her own benefit due to restrictions placed on the employee.

- Timekeeping (Use of Electronic or Paper Timesheets)

- Except as provided in VI.P of this procedure, the Southern Regional Technical College timesheet, as distributed by the Human Resources Department, is the official record of hours worked. NOTE: For adult education personnel and certain other part-tme work, an alternate timesheet as approved by the Director of Human Resources.

- All non-exempt employees and certain exempt employees (i.e. certain adjunct faculty) are required to keep a timesheet documenting all hours worked in accordance with this procedure.

- Full-time non-exempt employees must also use the timesheet to account for leave usage or leave without pay in addition to hours worked.

- Timesheets must be completed in accordance to the actual starting and ending times the employee works. For example, if the employee begins work at 8:04 a.m., that exact time must be entered on the timesheet. In accordance with TCSG Procedure: 4.2.1p. Working Hours, Overtime, and Compensatory Time, employee beginning and ending clock in/out times may be rounded to the nearest five (5) minutes.

- Falsification of actual starting and ending times of work will be considered an attendance and/or conduct infraction subject to disciplinary action as prescribed in the State Board policy on Positive Discipline.

- Additional rules that apply to the Electronic or Paper Timesheet system include, but are not limited to, the following:

- Clock in/out on the designated timesheet at the beginning and end of assigned shift;

- May not leave work prior to the end of assigned/scheduled work time, to include taking an unpaid meal period, without prior supervisory approval;

- Clock in/out on the designated timesheet for the unpaid meal period;

- May not take an extended meal or break period without approval;

- Must accurately and timely report hours worked;

- May not clock in/out early/late (except as provided in this procedure) of assigned shift without prior approval;

- May not clock in/out for any other employee;

- Any other behavior not specifically detailed herein that would be considered an infraction is subject to Positive Discipline up to and including separation from employment.

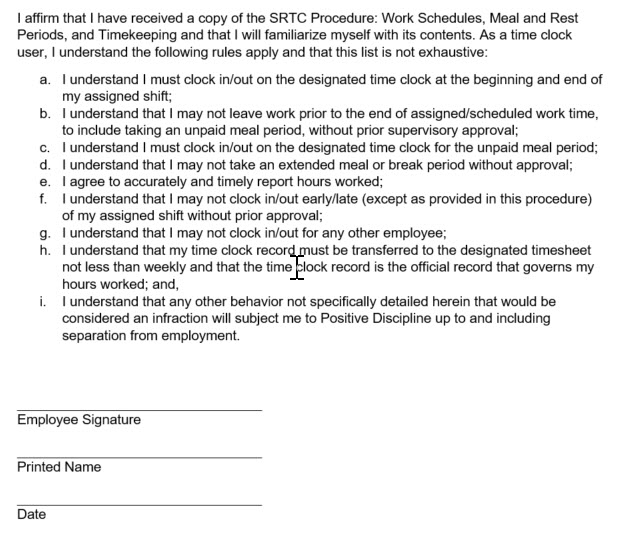

- Timekeeping (Use of Electronic Time Clocks)

- By direction of the President or his/her designee, certain job groups, work units, or other position(s) based on a business-related criterion may be directed to use an Electronic Time Clock in addition to an Electronic or Paper Timesheet. In these situations, the Electronic Time Clock report is the official record for determining hours worked.

- Electronic Time Clock users are required to sign Attachment C: Time Clock Acknowledgement to acknowledge the rules covering the use of this timekeeping system.

- The Electronic Time Clock must be used for all punches (clock in/clock out) to include starting and ending the work shift, for unpaid meal periods, and for appointments where partial leave is used for the day.

- Electronic Time Clock users may not clock in prior to five (5) minutes before their scheduled shift start time.

- Employees who clock in up to two (2) minutes past their scheduled work time will be considered to have clocked in on time.

For example, if the work shift starts at 7:00 a.m. and the employee clocks in at 7:02 a.m., he or she is considered to be on time. If, however, the employee clocks in at 7:03 a.m., he or she is tardy. - At no less than on a weekly basis, the Electronic Time Clock report must be transferred to the approved Southern Regional Technical College timesheet to document the hours worked in conjunction with leave usage or leave without pay.

- Direct supervisors are responsible for validating that Electronic Time Clock data is correctly transferred to the Electronic or Paper Timesheet prior to submission to payroll for processing.

- First time Electronic Time Clock users will be provided a thirty (30) calendar day introductory period for training purposes, beginning on day one (1) of use, to learn the system and to reinforce clock in/clock out behavior. A pattern of missed punches for any reason may be considered an attendance infraction subject to disciplinary action as prescribed in the State Board policy on Positive Discipline.

- Additional rules that apply to the Electronic Time Clock system include, but are not limited to, the following:

- Clock in/out on the designated time clock at the beginning and end of assigned shift;

- May not leave work prior to the end of assigned/scheduled work time, to include taking an unpaid meal period, without prior supervisory approval;

- Clock in/out on the designated time clock for the unpaid meal period;

- May not take an extended meal or break period without approval;

- Must accurately and timely report hours worked;

- May not clock in/out early/late (except as provided in this procedure) of assigned shift without prior approval;

- May not clock in/out for any other employee;

- Time clock record must be transferred to the designated timesheet not less than weekly and that the time clock record is the official record that governs hours worked; and,

- Any other behavior not specifically detailed herein that would be considered an infraction is subject to Positive Discipline up to and including separation from employment.

- Management of Work Hours

- Supervisors are responsible for monitoring the arrival and departure times of non-exempt employees and periodically reviewing time records during each established work period/work week in an effort to minimize unplanned and/or unauthorized overtime hours. At the conclusion of each work period/work week, the employee’s immediate supervisor must sign/authorize the time sheet or electronically approve the time record.

- All non-exempt employees must accurately record all hours worked, meal periods and leave taken on their designated time sheet or with a time clock or other time management system each work day. Hours worked outside scheduled work hours, including time spent on work-related telephone calls, must be recorded.

- As provided in Paragraph VI.B.6.and when possible, the work schedule of a nonexempt employee should be adjusted during the work period to avoid overtime.

- Falsification of time records, including the omission of hours worked, may result in disciplinary action.

- Generally, supervisors should obtain approval from their reviewing manager of other management official before permitting a non-exempt employee to work overtime, absent an emergency situation. In such instances, the supervisor should notify his/her manager as soon as possible and thoroughly document the reasons for the overtime.

- FLSA Compensatory Time Accumulation and Recordkeeping:

- Non-exempt employees will be provided one and one-half (1 ½) hours of FLSA Compensatory Time for each overtime hour worked and may accumulate up to a maximum of two hundred and forty (240) hours. Any FLSA Compensatory Time. Time accumulated in excess of this threshold must be delivered as a cash payment.

- Non-exempt law enforcement officers may accumulate up to a maximum of four hundred and eighty (480) hours. Any FLSA Compensatory Time accumulated in excess of this threshold must be delivered as cash payment.

- All accumulated FLSA Compensatory Time shall be recorded in the PeopleSoft HCM.

- Pursuant to FLSA regulations, the following records must be maintained regarding FLSA Compensatory Time:

- The number of hours of compensatory time earned each work week/work period by each employee;

- The number of compensatory time hours used each work week/work period by each employee;

- The number of hours of compensatory time compensated in cash, the total amount paid and the date of the payment; and,

- The written understanding or agreement regarding the earning and using of compensatory time off (obtained at time of on-boarding).

- Use of FLSA Compensatory Time

- In lieu of using accrued annual leave for an authorized absence, a non-exempt employee must use his/her FLSA Compensatory Time unless he/she would forfeit annual leave as a result of this requirement. This is the only instance in which a non-exempt employee will be permitted to use accrued annual leave in lieu of accumulated FLSA Compensatory Time.

- Non-exempt employees may request to use FLSA Compensatory Time in lieu of sick leave or personal leave; however, employees may not be required to use FLSA Compensatory Time in lieu of sick leave.

- Non-exempt employees must be permitted to use accumulated FLSA Compensatory time within a reasonable period after making a request for time off from work if granting the request will not unduly disrupt the operations of the work unit.

- If/when approved, an absence using accumulated FLSA Compensatory Time will be deducted from the employee’s PeopleSoft balance in the same manner as any other leave deduction.

- Payment for Accumulated FLSA Compensatory Time:

- FLSA Compensatory Time cannot be transferred between state agencies/entities, TCSG colleges, or colleges and the System Office. In addition, a compensatory time balance cannot be retained by a non-exempt employee who accepts an exempt position in the same TCSG work unit (e.g. a promotion). In these circumstances, the non-exempt employee shall be paid at the time of his/her transfer/reclassification for all accumulated, but unused, FLSA Compensatory Time. NOTE: The organizational unit from which the employee is transferring is fully responsible for the payment.

- An employee ending his/her state employment through resignation, separation or retirement shall be paid for all accumulated, but unused, FSLA Compensatory Time.

- The payment shall be delivered for each hour of accumulated, but unused, FLSA Compensatory Time at the higher of the following rates: a. The average regular rate received by the employee during the last three (3) years of employment; or, b. The final regular rate received by the employee

- As needed and based on the availability of funds, the FLSA Compensatory Time balance of a non-exempt employee may be reduced or “cashed out” completely at any time as determined by the Commissioner, a technical college president, or his/her designee.

- Monetary Payment of Overtime:

- The cash payment of overtime to a non-exempt employee (either salaried or hourly-paid) may only be delivered after approval of the TCSG’s Budget Office and the Office of Planning and Budget in the manner outline in Paragraph I of this procedure.

- In those instances in which a continuing need for overtime has been identified, itemized funds for overtime payments must be requested and included in the Technical College System of Georgia’s Annual Operating Budget.

- State Compensatory Time:

- State compensatory time may be granted to a non-exempt employee who remains in pay status for more than forty (40) hours in his/her established seven (7) day work period, but did not actually work more than forty (40) hours. State Compensatory Time apply to a non-exempt, P.O.S.T. certified law enforcement officer who remains in pay status but who did not work for more than the maximum number of hours in his/her work period. As an alternative, the TCSG work unit manager may elect to adjust the amount of leave to be charged to the employee during the work period, if such an adjustment will not result in the employee forfeiting leave or losing personal leave.

- If authorized, State compensatory time shall be provided on an “hour for hour”, straight time basis and an employee may not accumulate more than two hundred forty (240) hours.

- Employees should be scheduled to use accumulated State compensatory time within sixty (60) calendar days if at all possible.

- Any State compensatory time hours not used within one (1) year from the date earned will be lost. Additionally, an employee is not entitled to be paid for such hours.

- State compensatory time cannot be transferred between state agencies or between TCSG work units.

- State compensatory time should be tracked in the PeopleSoft HCM System and pursuant to OPB Policy, records regarding the accumulation and use of State Compensatory Time shall be managed in the same manner as FLSA Compensatory Time.

- General Record-keeping Requirements Under the FLSA:

- All non-exempt employees must record, by time sheet, time clock, or other time management system, all hours worked each work day and each established work period/work week. NOTE: an employee’s falsification of time records and/or the failure to record all hours worked in one or more work periods/work weeks may result in disciplinary action up to and including separation.

Responsibility

The Director of Human Resources has the overall responsibility for ensuring this procedure is implemented.

Reference:

SBTCSG Policy 4.2.1: Working Hours, Overtime, and Compensatory Time

TCSG Procedure 4.2.1p: Working Hours, Overtime, and Compensatory Time

SBTCSG Policy 4.2.2: Official Business Hours and Work Schedules

TCSG Procedure 4.2.2p1: Official Business Hours and Work Schedules

Status:

Adopted: 03-06-2018

Implemented: 03-06-2018

Revised: 09-18-2019

Attachment A: Work Schedule Form

Attachment B: Compressed Workweek Agreement Form

Attachment C: Time Clock Acknowledgement